An Activity-based Costing System Uses Which of the Following Procedures

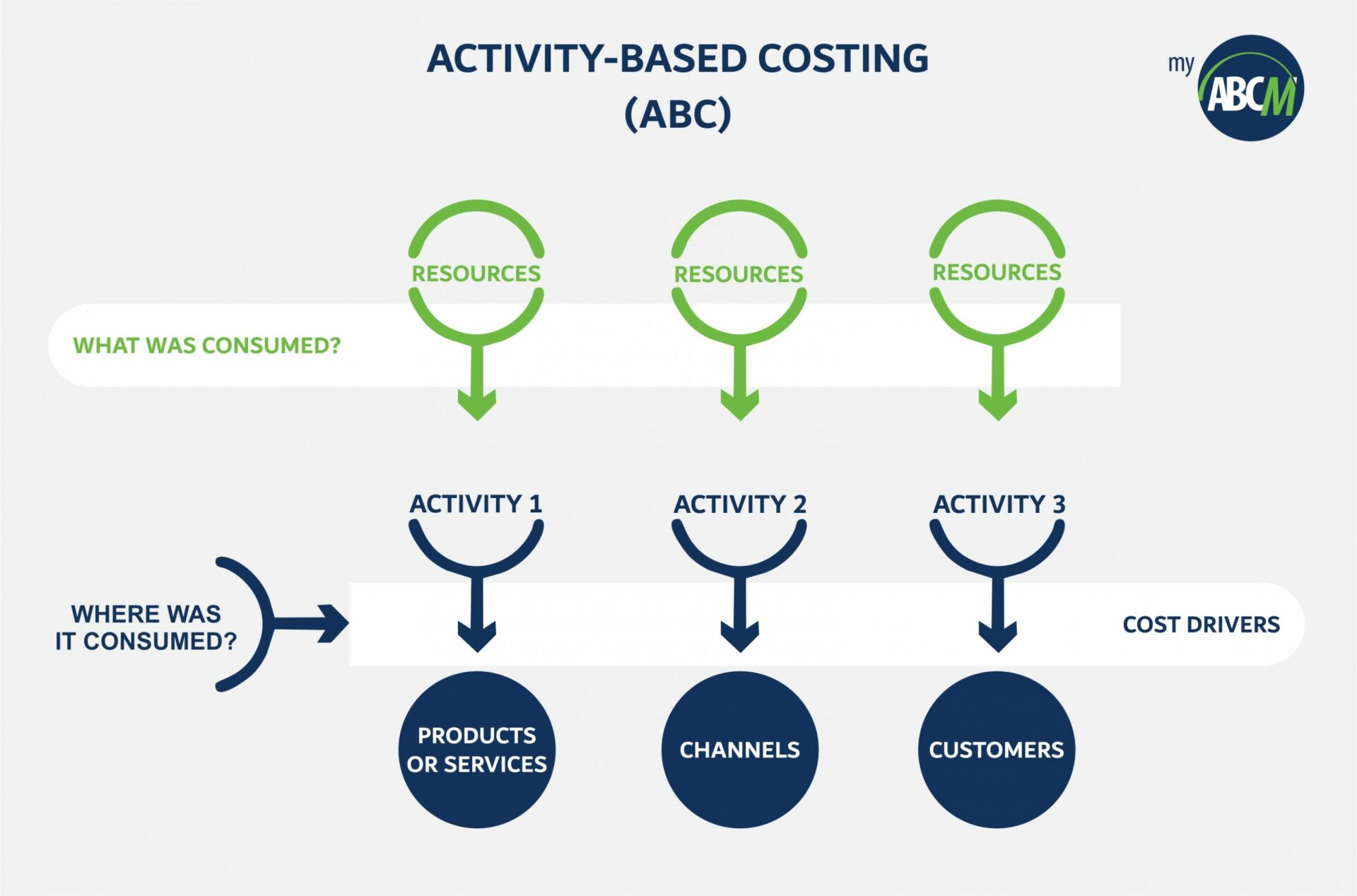

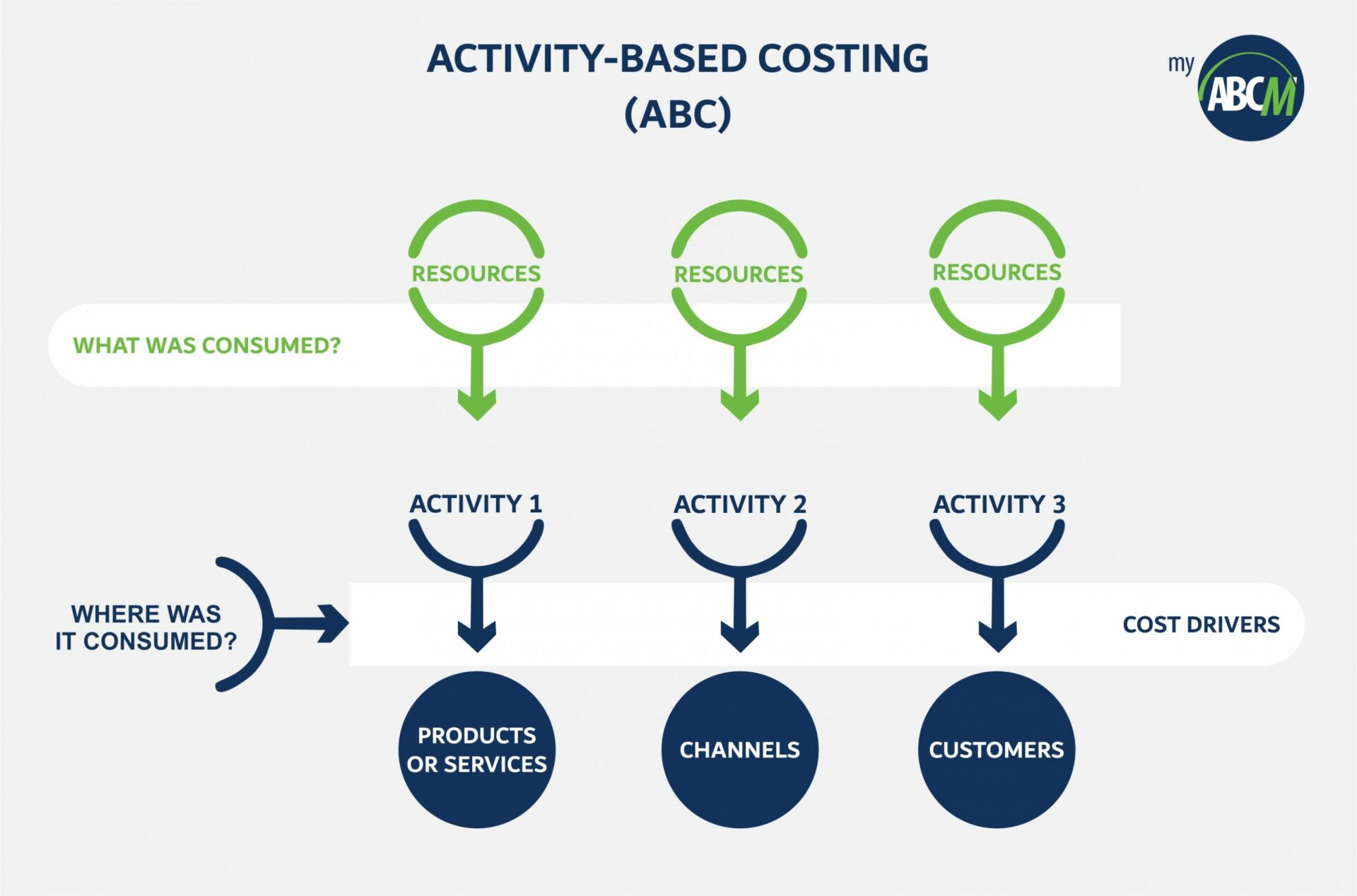

An activity-based costing ABC a costing method which allocated the overheads cost using the cost drivers. A few examples of the activities and appropriate cost drivers are stated below.

Traditional Vs Activity Based Costing Download Scientific Diagram

Overhead costs are traced to activities then costs are traced to products.

. 2 Identification of cost drivers. Under the ABC method the cost is allocated to different activities using the relevant cost drivers. All overhead costs are expensed as incurred D.

Unit-based product costing uses which of the following procedures. Overhead costs are traced directly to products. Overhead costs are traced to activities then costs are traced to products.

The following tasks are associated with an activity-based costing system. An activity-based costing system uses which of the following procedures. All overhead costs are expensed as incurred.

2 Overhead costs are traced to activities then costs are traced to products. Limitations of activity based costing are. Activity-based costing is more likely to result in major differences from traditional costing systems if the firm manufactures only one product rather than multiple products.

1 Overhead costs are traced to departments then costs are traced to products. B If management is not thinking to use ABC information an absorption costing system may be simpler to handle. An activity based costing system uses which of the following procedures.

Overhead costs are traced directly to products. Activity Cost Pool Total Activity Fabrication 10000 machine-hours Order processing 800 orders Other Not applicable The Other activity cost pool is used to accumulate costs of idle capacity and organization-sustaining costs. The activity based costing procedures are.

Thus it is used to better understand the companys true costs and thereby formulate an appropriate pricing strategy to mitigate unnecessary expenses. The first step in activity-based costing is to A. Use a single volume-based cost driver.

Advertising and Sales Promotion. It uses unit-based activity drivers to assign overhead to products. Working Procedures of Activity-Based Costing System.

All overhead costs are expensed as incurred. Overhead costs are traced to activities then costs are traced to products D. Assign manufacturing overhead costs for each activity cost pool to products.

3 Assignment of cost to products. Activity-based costing ABC is a methodology for more precisely allocating overhead costs by assigning them to activities. Overhead costs are traced to departments then costs are traced to products B.

The activities cost are used for calculating the product cost. A Cost and Benefit. Cost pools are used to assign.

Nature of activity or transaction decides a suitable cost driver Activity-based costing system uses an appropriate cost driver that differs with the nature of activities that create costs. 4 All overhead costs are expensed as incurred. An activity-based costing system uses which of the following procedures.

Activity-based costing ABC enhances the costing process in three ways. Some argues that the cost of implementing and maintaining an Activity Based Costing system can exceed the benefits of improved accuracy. Activity-based costing ABC uses several cost pools organized by activity to allocate overhead costs.

Overhead costs are traced directly to products C. In activity-based costing cost drivers are what cause costs to be incurred. Tatman Corporation uses an activity-based costing system with the following three activity cost pools.

The following unit manufacturing costs have been determined using traditional absorption costing and activity-based costing. Advertising and Public Relations. Use the following information for the next four questions.

A time-based cost driver is used to charge the procurement costs to the tablets under the ABC system. It uses traditional product costing definitions. Activity-based costing serves and complements many other analyses and measures including target costing product costing product line profitability analysis service pricing and more.

First it expands the number of cost pools that can be used to assemble overhead costs. Select the activities and cost-allocation bases to use for allocating indirect costs to the products. This model assigns more indirect costs overhead into direct costs compared to conventional costing.

Asset Demand and Supply under Uncertainty. Identify the indirect costs associated with each cost-. The following tasks are associated with an activity-based costing system.

Once costs are assigned to activities the costs can be assigned to the cost objects that use those activities. All overhead costs are expensed as incurred. Company is now considering opting for using Activity-Based Costing ABC on a trial basis for its procurement operation.

It offers greater product costing accuracy than an activity-based costing system. Typically use fewer cost drivers than more traditional costing systems. Only if a cost driver cant be recognized a cost can be assigned on an allocative basis.

Identify and classify the major activities involved in the manufacture of specific products. Overhead costs are traced to departments then costs are traced to products. Adjusting Accounts for Financial Statements.

3 Overhead costs are traced directly to products. Activity-based costing is useful for allocating marketing and distribution costs. Related cost pools are assigned to an overhead rate on costs drivers.

Overhead costs are traced to activities then costs are traced to products. Overhead costs are traced to departments then costs are traced to products. Currently uses traditional costing procedures applying 800000 of overhead to products Beta and Zeta on the basis of direct labor hours.

It is a costing method that assigns overhead and indirect costs to related products and services. An activity-based costing system uses which of the following procedures. 4 Identification of cost pools.

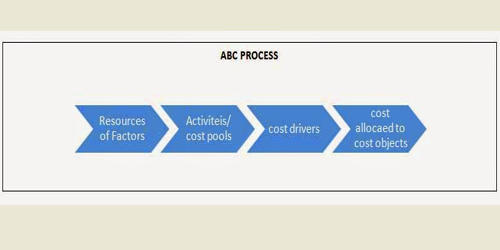

Assign overhead to products based on the products relative usage of direct labor. 1Calculation of cost application rates 2Identification of cost drivers 3Assignment of cost to products 4Identification of cost pools. AN ACTIVITY-BASED COSTING SYSTEM 5-3 ABCs 7 Steps Step 1.

The system can be employed for the targeted reduction of overhead costs. An activity-based costing system uses which of the following procedures. Compute the activity-based overhead rate per cost driver.

Analysis and Forecasting Techniques. Often reveal products that were under- or overcosted by traditional costing systems. It is cheaper than an activity-based costing system.

Analyzing and Recording Transactions. Atleast two of the answers are correct E. Identify the products that are the chosen cost objects.

Identify the direct costs of the products. 1 Calculation of cost application rates. Overhead costs are traced to departments then costs are traced to products B overhead costs are assigned to products C.

What Is Activity Based Costing Meaning And Suitability Finlawportal

Activity Based Costing Everything You Need To Know About The Abc Methodology Myabcm

Working Procedures Of Activity Based Costing System Assignment Point

No comments for "An Activity-based Costing System Uses Which of the Following Procedures"

Post a Comment